Gold and silver prices have been down most of the day, with the gold futures currently down $16 to $2,877, while silver’s down 28 cents to $32.69.

However, in terms of the chaos beneath the surface of the market, well...let’s just say there’s plenty to cover. And if a picture is worth a thousand words, I’ll try to condense a few tens of thousands of words down to a few pictures today, along with a few links for additional reading/viewing for what you’d like to dig into further.

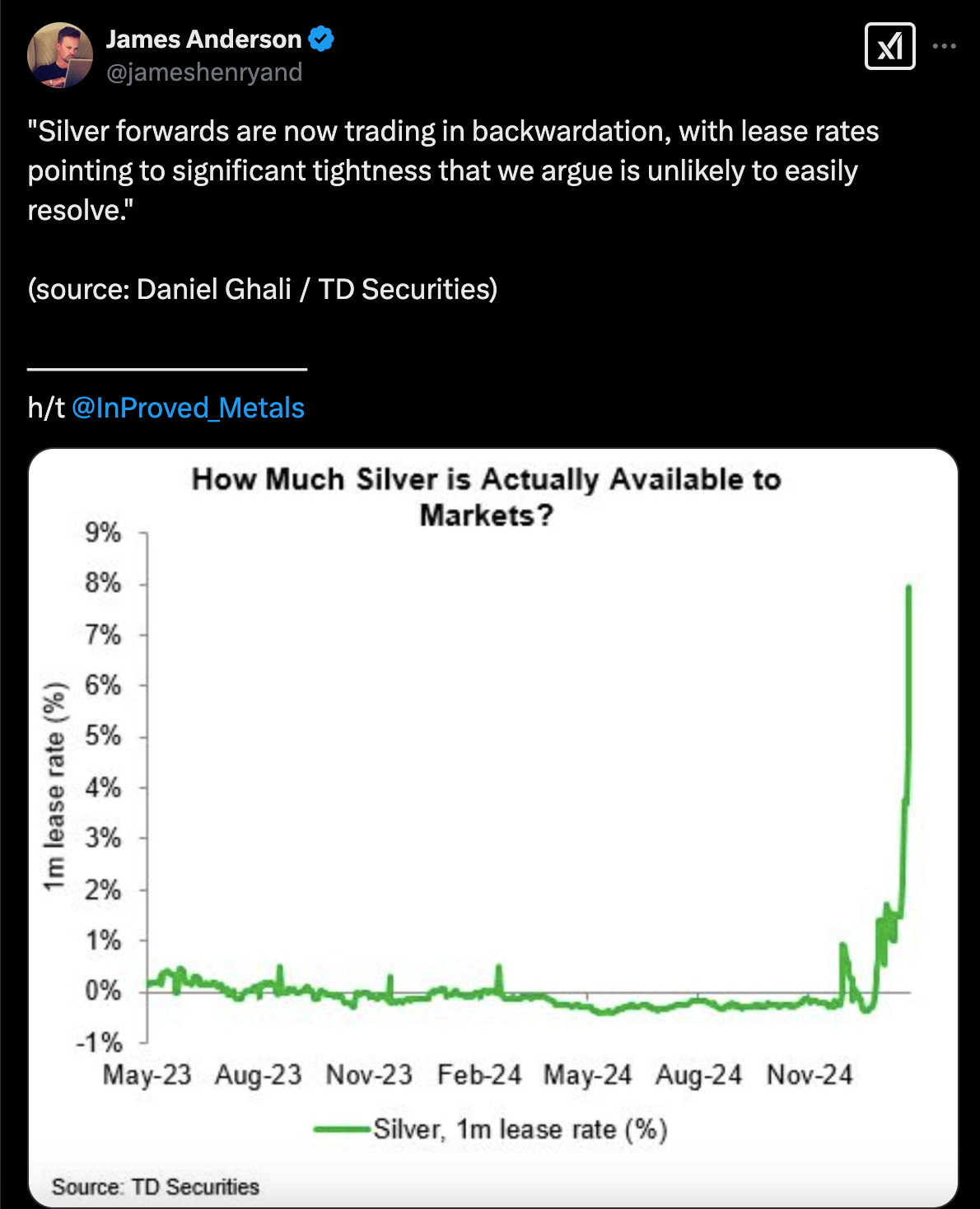

First off is James Anderson quoting Daniel Ghali of TD Securities (who we write about often here, as he’s shared some particularly interesting silver comments over the past year), who mentions how silver forwards are now in backwardation.

James also highlighted former JP Morgan precious metals managing director Robert Gottlieb’s comments on the surge in gold and silver borrowing rates.

And for further commentary from Robert on the severity of the tightness in the silver market, you can see his thoughts here.

My colleague Vince Lanci also recorded a broadcast this morning that goes deeper into the gold and silver lease rates, what that means, and what kind of pressure that puts on the market going forward.

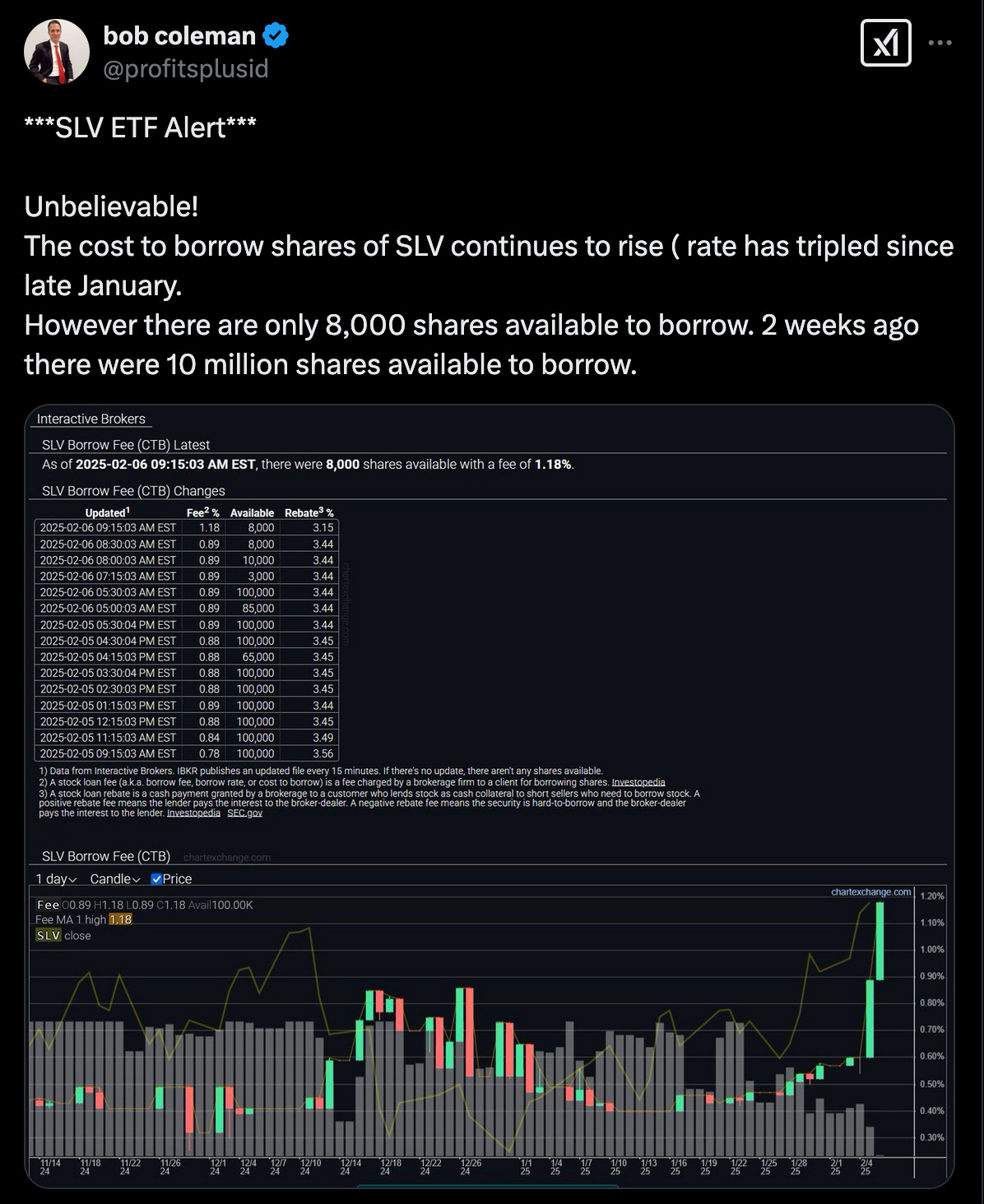

In terms of other developments in silver, we can also see that large amounts of silver are being withdrawn from the SLV trust, while the cost to borrow shares has tripled since late January.

And here Luke Gromen points out how even despite the recent rally, we’d still have to reach $6,300 gold just to get back to the 1989 levels of US official gold held as a percentage of foreign-held US treasuries.

Then, just at the perfect time, Kevin Bambrough, who used to be an asset manager at Sprott during the time when they tried to take a large delivery of physical silver, provides a great first-hand account of what actually happened (there have been a lot of stories floating around over the years), and how vulnerable he thinks the silver market currently is to a fracture.

“When we decided to take delivery, what should have been a routine 5-day process turned into a nine-month odyssey of excuses and misdirection.”

I highly recommend reading his full post (you can click on the image to be taken there), although in terms of one more highlight, I’ll share this:

“But here's what makes this time different: we're on the cusp of a robotics revolution. From home cleaning robots to industrial automation and autonomous mining equipment, the coming wave of automation will require massive amounts of silver for solid state batteries and electronics.

Add in the growing energy storage needs for wind and solar power, and we're looking at structural demand that dwarfs anything we've seen before.

The coming silver bull market will be unprecedented for several reasons:

Global silver inventories and central bank holdings have been depleted to record levels vs the huge inventories present in the 1970's

Mining projects face unprecedented permitting challenge and delays

Industrial demand is structural and growing

Major exchanges have shown a history of failure to deliver in other commodities

Physical premiums are expanding

The monetary system is more fragile than ever

When the market finally breaks, we'll likely see exchanges failing to deliver physical silver, forcing cash settlements. This will drive people to seek physical metal, creating a self-reinforcing cycle. Just like in the 1970s, we'll see panic buying silver coins and bars. But, this cycle people won’t be lining up in the streets. We will see the "sold out" signs appear globally on bullion selling websites.”

His comments are actually quite similar to what Rick Rule (who was involved with the Sprott PSLV trust during the #SilverSqueeze in 2021) mentioned recently about what he experienced when they cleared out the silver inventory in multiple cities.

Finally, for our last note of the day, there’s the following story from Bloomberg (reposted on Yahoo finance).

The key highlights in this one include:

“Gold in the Bank of England vault is trading at a discount to the wider market, as fears over potential Trump tariffs spark a scramble for bullion that’s resulting in weeks-long queues to withdraw metal.

Dealers are quoting prices for gold at the BOE at discounts of more than $5 an ounce below spot in London, according to people with direct knowledge of the situation.

The size of the divergence is extremely unusual, with gold at the BOE usually trading in lockstep with prices in the rest of the London market, where bullion changes hands in vaults a few minutes’ drive away run by JPMorgan Chase & Co., HSBC Holdings Plc and others. Previous premiums and discounts — driven by central bank trading activity — have generally been no more than a few tens of cents per ounce, traders said.

The tightness can be seen in one-month lease rates for bullion, which have jumped to about 4.7%, far above the usual level of close to zero. The rate reflects the return that holders of bullion in London’s vaults can get by loaning their metal out on a short-term basis.

Forward prices for gold in one month are currently below spot rates, according to data compiled by Bloomberg. That structure, known as backwardation, is highly unusual for the gold market.”

So just in case you didn’t like all those years where it seemed like following the precious metals markets felt like watching paint dry, hopefully you’re enjoying the current activity.

We have the latest labor report on deck for tomorrow, so there’s a good chance of a big move in one direction or another to close out the week, and hopefully today’s column gives you some things to think about and examine until then.

Sincerely,

Chris Marcus

P.S. If you enjoyed today’s column, be aware that this is a daily newsletter, and you can easily upgrade to receive each column by clicking here at any time!

https://x.com/InvResDynamics/status/1887615699410928094

Seems to me as a student of the metals market, a good old fashioned bank run is under way in the gold market. No one trusts anyone and everyone wants their metal in their possession. Possession is 9/10 of the law as the adage goes and I’m sure there are people that loaned/leased their gold out and may not get it back. May have already happened for all we know as the market plumbing seems to be secretive.

There may be plenty of gold in the vaults but only a select few know for sure.

Should be interesting over the next few weeks.

Thanks Chris for your expertise and work. Would be interested in the 2nd edition book myself.