It was another record-setting day in the precious metals markets, as the gold futures briefly ticked over $3,100, while the silver price experienced multiple surges and shot higher to $35.23.

That’s of course another new all-time record high for the gold futures.

And here you can see the big day for silver.

Today’s silver high of $35.40 is the new high of the year, and also surpassed the 2024 high of $34.07

It’s also the highest the silver price has been since March of 2012.

Of course underneath the surface of the price reaction is the continued stress in the silver market.

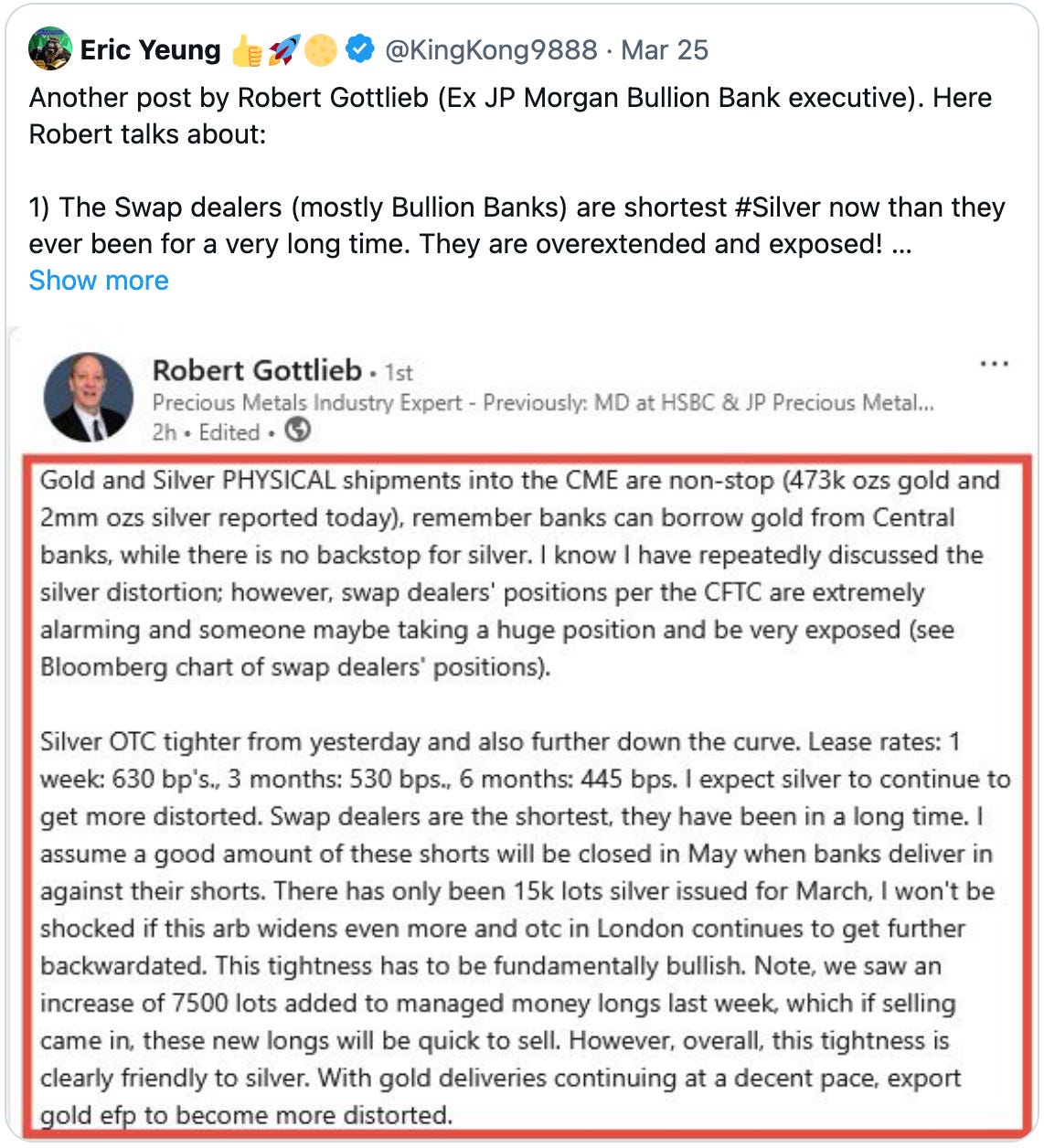

I’ve mentioned former JP Morgan precious metals managing director Robert Gottlieb’s commentary several times in the past few weeks, and his latest comments did not disappoint.

In case you were skimming, a few particular highlights include:

‘banks can borrow gold from Central banks, while there is no backstop for silver’

‘swap dealers’ (banks) positions per the CFTC are extremely large (which we reported on earlier this week) and someone may be taking a huge position and be very exposed’

‘I expect silver to continue to get more distorted’

‘swap dealers are the shortest they have been in a long time’ (the only time their short position has been large was in July of 2016)

‘the tightness has to be fundamentally bullish’

‘expect gold EFP to become more distorted’

Robert was also recently a guest on the Silver Institute's podcast, which I recommend listening to.

Especially after hearing his interview, it was interesting to see the comments in his more recent post, where he talked about how one of the silver banks could really be exposed. Which seemed somewhat in contrast to what he mentions in the interview, where he said that the bank short positions are generally offset by physical hedges in London.

Which is a topic I’ve talked a lot about in recent months, and always offer the caveat of how even though the banks have a large short position, we don't know exactly what offsetting hedges they have in place.

In his interview Robert made it sound as if the banks are typically fully hedged and left with minimal exposure, although many others I have spoken with feel that the hedges are minimal at best.

Perhaps the answer lies somewhere in the middle. Yet more significantly is that there has been a correlation between the net bank short position and the price. And perhaps even more importantly than that, is that regardless of how much hedging is actually taking place, apparently whatever amount that is, in Robert's opinion it has still potentially left one of the banks exposed.

Keep in mind that this is also coming just days after my colleague Vince Lanci reported the following:

“A major US Bank is believed to be losing money and struggling to make certain Silver and Gold obligations in a timely fashion due to physical demand outstripping their own unencumbered vault supply.”

And while we’re giving Vince his due credit, keep in mind how he also reported last week on an LBMA silver squeeze was brewing. Which we are seeing the impact of today.

Speaking of the banks, just like during the rally last year, the banks are struggling to keep up raising their targets as the price blows past their old ones.

Bank of America just raised their gold price target, while also commenting on how the Chinese insurance industry has now been given new access to the market.

This morning there was also a gold price update from Goldman Sachs that mentioned how in the case of ‘extreme tail scenarios,’ the price could rise as high as $4,500.

Regardless of how you feel about Goldman Sachs and whether or not they might be talking their book, it still seems to be a net positive that $4,500 gold is being discussed in Wall Street circles today.

So if you’re a long-time precious metals investor, make sure to celebrate and enjoy this one. It was certainly another exciting day, and I’ll look forward to rounding up the week with you tomorrow.

Sincerely,

Chris Marcus

How exciting 😁... $36+... Incoming

I watched the Lanci interview on Palasades yesterday and members of my metals group sent me this. Lanci was saying that the reason PSLV is being shorted is to keep them out of the market. PSLV is buying again. Also one is saying it’s HBSC that’s in trouble.

Have a shot of the Sprott page but can’t load it here.