Precious Metals Reverse Higher After Strong Labor Report, Stocks Stay Down, Bond Yields Surge Again

Well... for those of you who like some action in your financial markets, hopefully today did not disappoint.

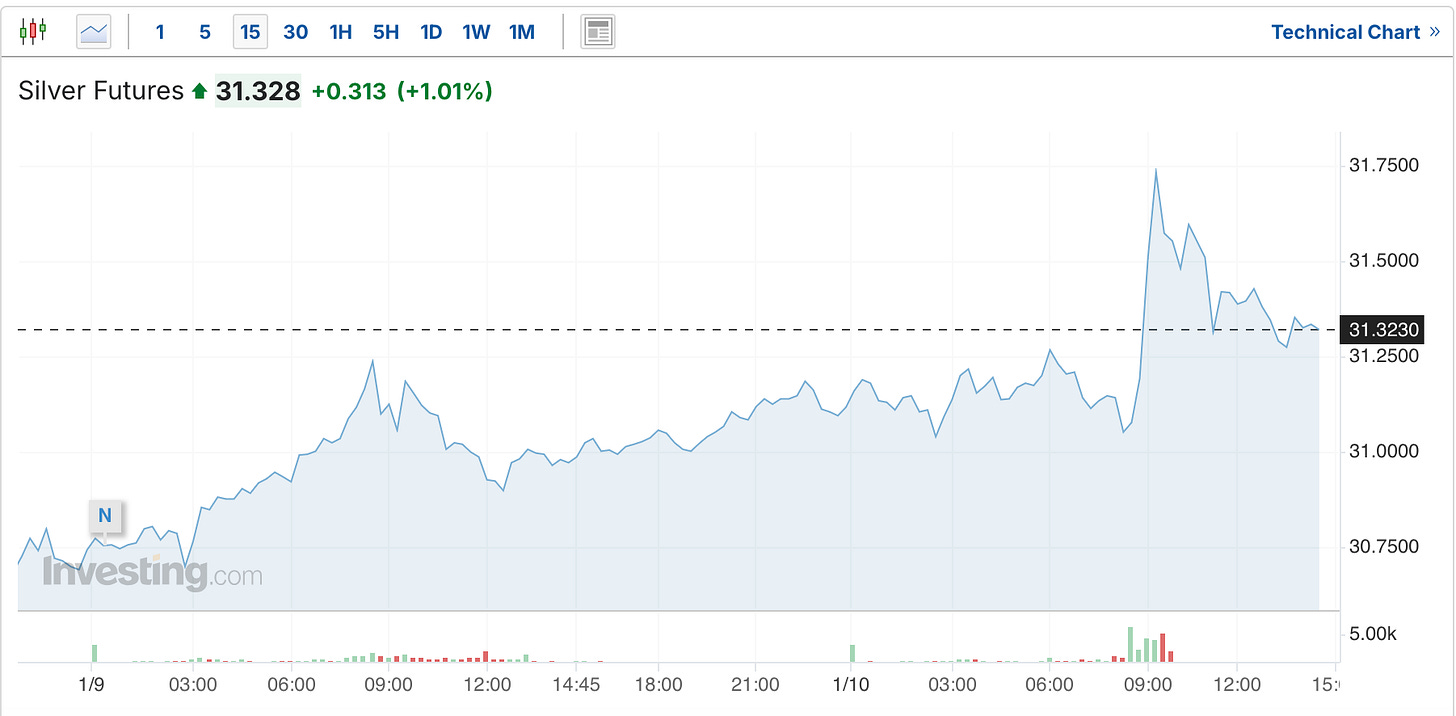

Because following this morning’s stronger than expected labor report (at least according to the government's numbers and Wall Street's interpretation of them), we've seen big moves in gold and silver (in both directions), that have left both metals up almost 1% at this point in the session.

Which perhaps is even more noteworthy given that the stock markets in the US have all been down substantially for most of the day.

Further dashing the market’s hopes for additional rate cuts was the University of Michigan's survey showing one-year inflation expectations jumped to 3.3% in January, from 2.8% in December.

In response, the odds of a pause at the Fed’s next meeting remained near 100%, while the odds of a cut in March fell from 41% to 25%.

Further compounding the issue is the surge in the dollar index and bond yields, with both experiencing additional moves higher on Friday. That are starting to simultaneously create a drag on growth, and put additional pressure on the US treasury market. Especially as issuers of foreign-denominated debt sell treasuries to meet the increased dollar expense to service their debt.

Here’s the latest blowout in yields, which have risen relentlessly ever since the Fed started cutting short-term rates back in September. And are now 116 basis points higher than just before the Fed’s September 18th 50 basis point cut.

Meanwhile, the dollar index, after coming back in earlier this week, is now back over 109, and up more than 9.5% since the Fed started cutting.

Of course, this is all before Trump’s even made it into office. And as we’ve written about over the past 2 months, if his tariff and cost-cutting policies are advanced as suggested, we remain on track to see the amount of road that’s left for governments and central banks to kick the can down shorten significantly.

Perhaps the best example of this is actually taking place in the gold and silver market right now, where for the 2nd time in the past month, the EFP premiums (the spread between the spot market in London and the COMEX futures) have blown out due to concerns about how the tariffs could impact the precious metals industry.

Just as a reminder, when the EFP spreads blew out in 2020, large losses were reported by several of the bullion banks (with others likely also experiencing similar losses, that were just not made public).

Here’s a look at what happened to CIBC’s gold book.

And it didn’t go all that much better for HSBC.

On Wednesday we talked about how the spreads were starting to blow out again, and that’s continued again today, with the gold EFP reaching $30, while silver is up to $1.00.

In terms of how to interpret what to make out of the surge in the premiums, I’ll share what I mentioned earlier this week when the premiums first shot up.

“Perhaps a good way of phrasing it, is that similar to when a futures market goes into backwardation, a surge in the EFP premium is not a guarantee that something is about to happen. But still a warning sign that something unusual is occurring, and an indication that there could be an elevated probability of tightness or stress in the system.

So it’s noteworthy when it happens, and certainly something you want to keep an eye on.

The premiums could come back in tomorrow. Although it's also possible that a month from now, we could have just witnessed something similar to the EFP crisis of 2020.

But premiums are surging because of concerns about how the Trump tariffs could impact the precious metals supply chain. And the surge could be thought of similar to your fire alarm going off.

Where it's possible it’s malfunctioning and picking up something that's not there.

But it’s also possible that the alarm’s working just fine, and your house is actually on fire.”

Bloomberg also put out an article about the situation on Thursday, that has some noteworthy comments from TD Securities analyst Daniel Ghali. The same analyst who put out a report last year where he talked about ‘the next silver squeeze,’ which he expected to occur based on the rate of the deficit and the draw-down of the above-ground stockpiles.

“The market is sleepwalking into a squeeze right now.

People are completely disregarding this risk.”

The Bloomberg article also mentions:

In the silver market, major dealers can ship metal from London to New York warehouses to close out arbitrage trades, and 15 million ounces of silver have been added in Comex silver warehouses during the past five weeks.

But stockpiles in the London market have been drained heavily following four years of severe shortfalls in global mined silver production, and further outflows risk creating a knock-on spike in prices.

“We expect the drain to be significant in scale,” Ghali said. “This is the silver squeeze that you can buy into.”

Ghali was also interviewed about the situation, which you can find here, and is worth watching.

And one final note is what Steve St. Angelo of SRS Rocco mentions here, about how the LBMA silver inventories declined by 23 million ounces in December, and are at a new record low.

Add that all together, and it’s probably wise to expect the volatility to continue. Especially in late January as Trump finally takes office and begins implementing his plans.

But we’ll cover that when we get there, and for now, I do just hope that you’re able to enjoy a wonderful weekend, and I’ll see you on Monday!

Sincerely,

Chris Marcus

Thank you Chris

Thats a very well writen article that explains the big picture... Thanks Chris!