If COMEX Silver Shorts Are Really Hedged, Then London 'Free Float' Is Only 7.5 Million Ounces

And Either They're Hedged 1:1, Or Someone Has A Short Exposure As The Price Is Rising

The gold and silver prices came back in a touch on Tuesday following Monday's silver rally that briefly saw the price climb over $37 per ounce.

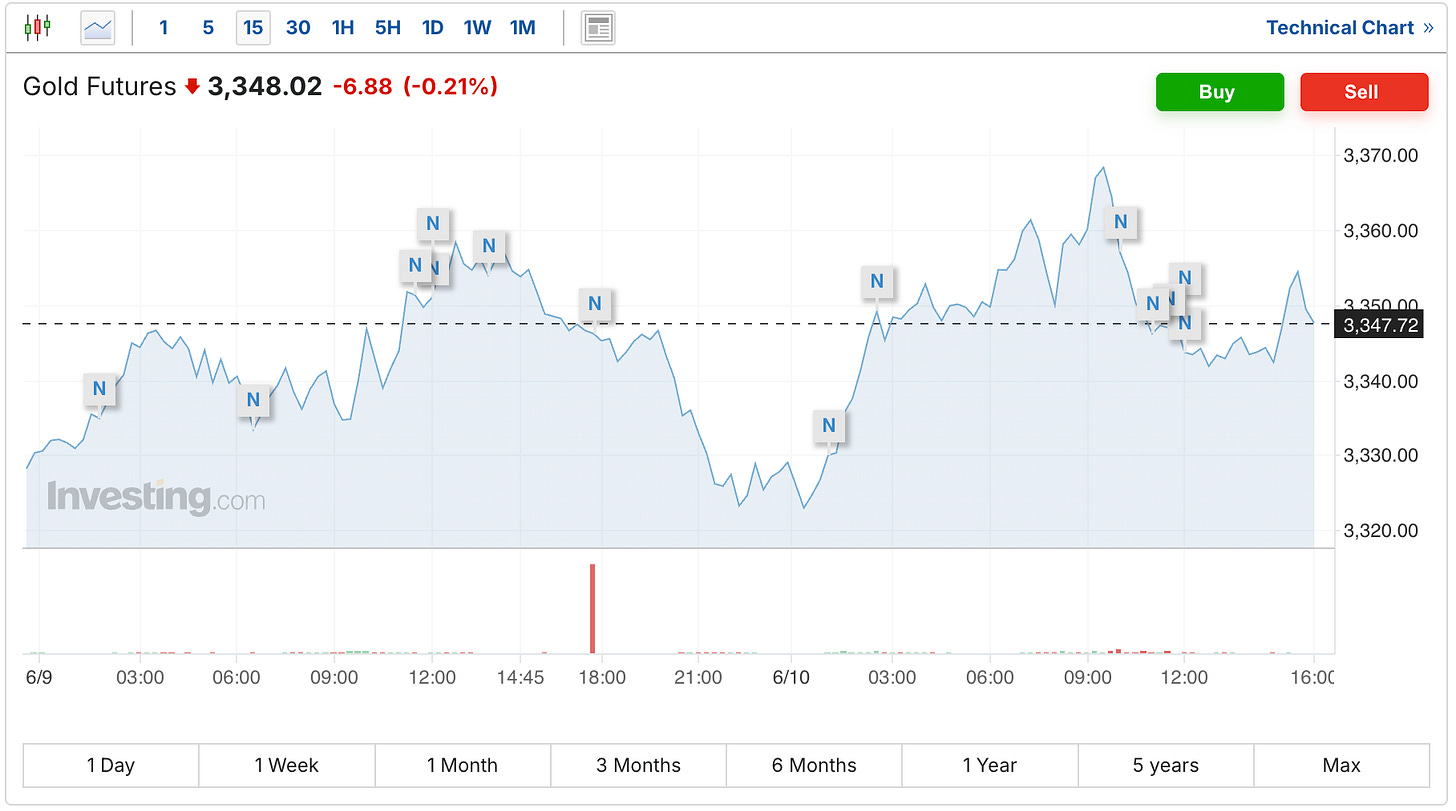

The gold futures were down $7 to $3,348.

While silver pulled back 9 cents to $36.70.

In yesterday's recap I mentioned how the banks short position in the silver market had reached the second highest level in history, and remains only 4,000 contracts away from the all-time record set in July of 2016.

And given how the price has risen $2 since the cutoff from last week's report, which extends to the end of today's trading, there's a good chance that the banks once again increased their short position in this week’s reporting period.

It's possible that they may have even broken the record. We will find out on Friday.

However there was something else that was mentioned yesterday, which I just felt was worthy of taking a closer look at.

Keep reading with a 7-day free trial

Subscribe to Arcadia Economics' Gold & Silver Daily to keep reading this post and get 7 days of free access to the full post archives.