It was another somewhat quiet day for gold and silver on the COMEX, as the gold futures are trading $20 lower at $3,327, while the silver futures were down 11 cents to $32.89.

I suppose compared to what we've witnessed over recent months, the news flow regarding the tariff war was not quite as frenetic today.

Although there were still a few events that are relevant to the gold and silver markets, and one that also ties in with a recent shift in the precious metals market in India.

However, first was this wild story from CNN, about the Chinese government sending a message to Trump and the US via a rather well-crafted and theatrical video. That announced (amongst other things) that China won't ‘kneel down’ to the US.

Here's the video if you have not seen it yet. It's rather intriguing, especially in the way that a well-produced media clip like this is being used as a weapon in the international court of public opinion in the ongoing tariff war between the US and China.

Here are a few samples of some of the thoughts China shared in the video regarding their assessment of US foreign policy.

“China won’t back down so the voices of the weak will be heard”

“When the rest of the world stands together in solidarity, the US is just a small stranded boat”

“Someone has to step forward, torch in hand, to shatter the fog and illuminate the path ahead.”

“Bowing to a bully is like drinking poison to quench a thirst.”

I mentioned a few weeks ago how a recent report from Pepe Escobar suggested that the tone in China is currently one of defiantly mocking the US. And this latest video would suggest that they have no plans to back down any time soon.

Makes me think about how as US foreign policy became more aggressive in recent decades, geopolitical analysts, and just regular people (including your typical gold and silver investors) have wondered what would happen if one day someone was able to stand up to the US government.

At least at the moment, it seems like we may be finding out.

While the trade war between the US and China shows little sign of resolution in the immediate future, there were indications that a deal between the US and India may be closer to being reached.

I’ll be keeping an eye out for the details of this deal. Because this progress comes shortly after it was reported by the Hindustan Times that it was being discussed that the trade imbalance could be resolved by the US sending gold and silver to India.

It will be fascinating to see what the Indian gold and silver import numbers would look like if that is the arrangement that ultimately gets reached.

It would also be happening at a time when a CNBC India reporter made a comment suggesting that ‘a lot of gold demand has shifted into silver because of the all-time high prices here.’

The context of her quote was a little bit less than clear. But you can hear what she says at the 2 minute and 45 second mark in this clip with Michael Dirienzo of the Silver Institute. And if you are a silver investor in particular, I think you would find the whole clip worth your time, as he also summarizes his conclusions from the recent World Silver Survey.

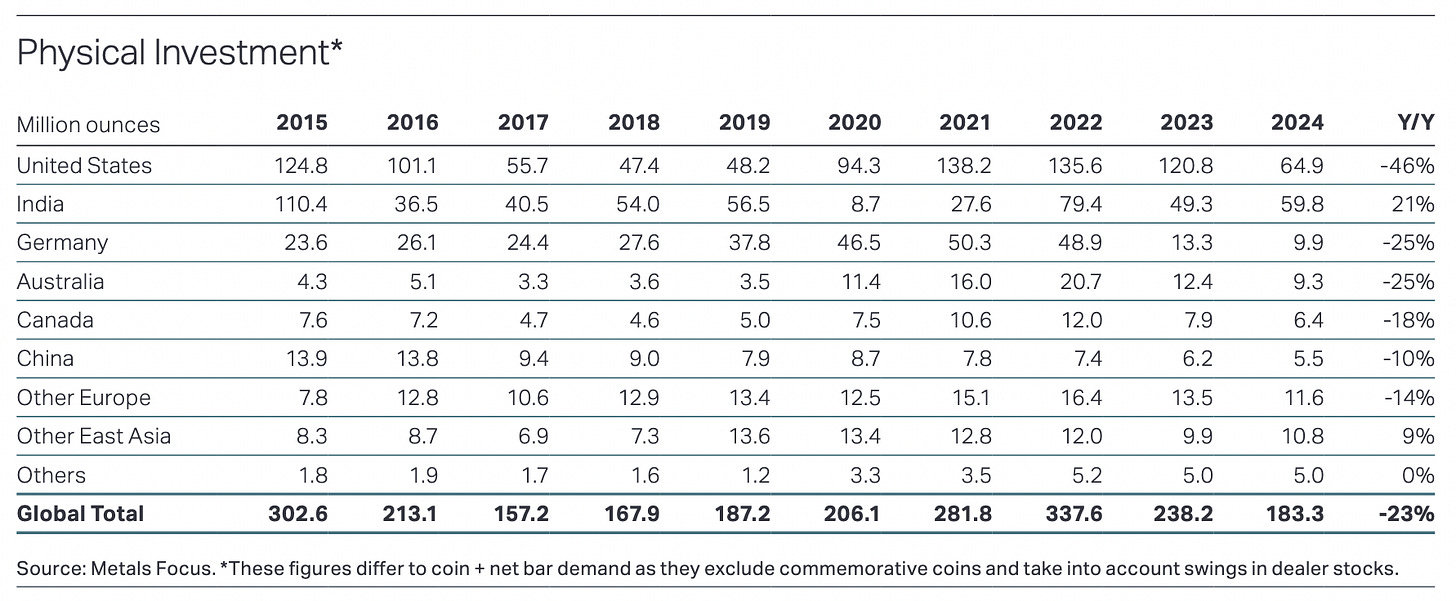

The chart below here shows silver investment demand by country, and you can see that while Indian investment demand has been somewhat volatile in the last few years, it did rise last year, and we’ll see if demand does indeed shift more to silver.

Given India's reputation as a price sensitive buyer, I would think the current price levels could indeed have an impact. But we will see as the year goes on.

Yet at least as of today, it seems like the country that the US is not on the verge of reaching a trade deal with is in the midst of a gold mania, while the country that the US was able to reach a trade deal with, may be taking the United States’ gold and silver.

Sincerely,

Chris Marcus

Seriously a great read if you were away from the markets today...Thanks Chris