As we round out what was a relatively quiet week in the gold and silver markets (at least compared to what we’ve seen throughout most of 2024), the big news on Friday was CME’s launch of 1-ounce gold futures, and the November labor report.

The CME put out a press release announcing the new contract that mentioned the following:

On one hand, it would make sense that retail gold demand would surge as the price (at least on the gold side) has been hitting new all-time record highs throughout the year.

Although despite the rally, retail interest has largely remained subdued.

You can also see in the bottom box how there’s not been a noticeable surge in COMEX gold volume (although that’s less of a retail measurement).

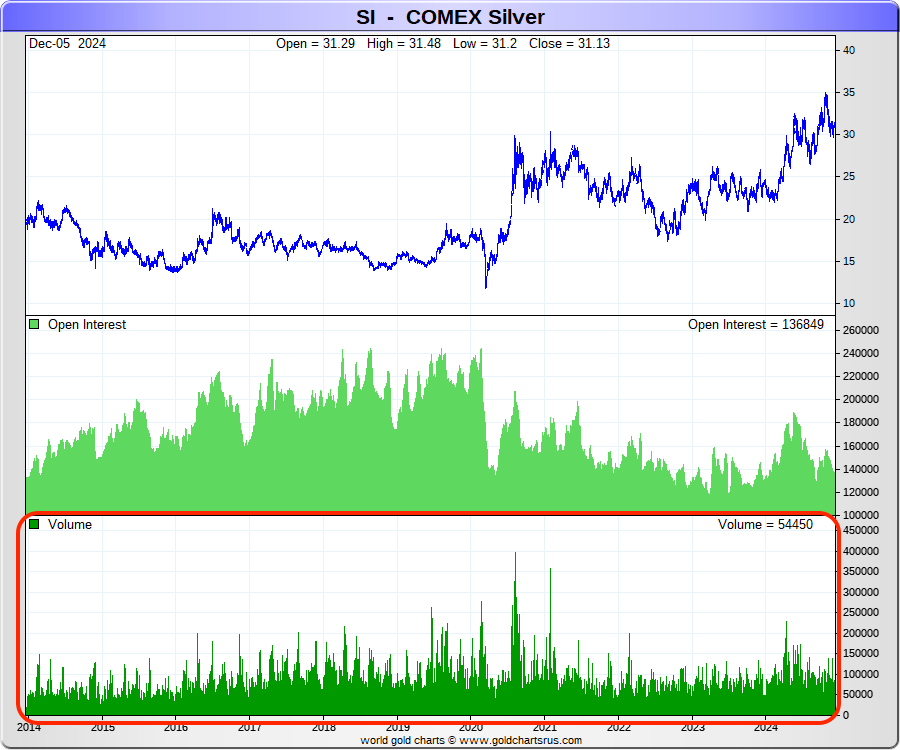

Similarly with silver, there’s nothing out of the ordinary happening in the volume lately.

Additionally, while there’s a bit of a divide between the physical retail, industrial, and futures markets, on the physical retail level, there continues to be a lot of selling.

I recently spoke with wholesaler EF Bullion (run by Matt Riley, who’s also a great Twitter follow) who told me this week:

So while there perhaps ‘should’ be more interest on the retail level, so far that hasn’t been the case. At least by those two metrics.

Be aware that the CME also mentioned that “1-Ounce Gold futures will be financially-settled based on the daily settlement price.”

The other news on Friday was the release of the latest labor data. Where job growth was reported at 227k, vs a weak prior month of 12k (although that was revised up to 36k), and expectations of 220k.

September was revised upwards by 32k, and October was revised up by 24k, while unemployment rose from 4.1% to 4.2%. However, the household survey fell by 355k to 161.1 million, while full-time jobs dropped by 111k, and part-time jobs fell by 268k.

That left the futures markets pricing in an 85% probability of another Fed rate cut at the next meeting in 2 weeks.

All of which left gold up $6, and silver up 5 cents to close out the week.

So hopefully it was a great week for you, and you enjoyed the slightly less frantic pace of activity. We’re now in December and rolling towards the holidays, so go out and have a great weekend, and I’ll see you again next week!

Sincerely,

Chris Marcus

Could this signal that the comex is fighting for its life? Great read Chris. Thank yiu!

Could it be that the CME is anticipating surging demand from an awakening retail sector and is setting up the 1oz contract to soak up at least some of it? The scam continues. Smells of desperation? Is silver next?